The Ecosystem Opportunity Connecting Health and Home

Simon Browning, Chief Operations Officer and Michael Wandschneider, Director, Strategic Planning

While the convention halls at CES 2022 were not able to return to their pre-pandemic levels of energy and excitement, the mood was (cautiously) upbeat and optimistic. We were disappointed to note that among all of the usual connected gadgetry and the shiny new potential of a ‘metaverse’ there were still no viable solutions to the reason CES was, at best, a hybrid event. Our physical worlds are not limited to discrete, one-on-one interactions, but are intricate and interconnected ecosystems. And connected devices that operate on the principle of singular, one-way transactions fall well short in helping us navigate this complexity.

With K/BIS and IBS around the corner (and with the same storm clouds hanging overhead), we are still waiting for companies to embrace and promote a view of connected wellness that empowers their consumers to improve their lives, educates them on how to do so, and incentivizes them to engage in a long term relationship within their ecosystems.

The Convergence of Health & Home

We see three big areas of opportunity that companies will need to prioritise if they are to take advantage of this shift in their industry;

1. Connected Health

Our homes are being redefined as demand continues to grow for spaces that are well connected and compatible with the proliferation of smart products and services that will support modern lifestyles – at the heart of which sits Wellness. The values of comfort and control that emanate from the place we call home, and all that we do in it, make this a highly lucrative sector. Mental Wellness alone is reportedly now a $120BN market.

At CES this year, Gary Shapiro, president and CEO of the Consumer Technology Association, discussed how ‘the pandemic spurred rapid innovation from digital health companies across the globe who continue to find ways to make our lives safer, happier and longer’. This industry acceleration may explain why over 100 health companies exhibited there this year. Not to mention the various talks on virtual clinics and Abbot CEO Robert Ford’s discussion of ‘the relentless pursuit of health’ (also on YouTube here)

2. New Competitive Threats

Barriers to entry that once protected established industries are no longer insurmountable for outsiders to penetrate. And consumers armed with unlimited information are not satisfied with traditional solutions to their needs and will invite these outsiders into the traditional marketplace at an increasing rate.

3. Digital Transformation

Well and Good reported on this trend and Hybrid Health-Care Models that meet people where they are by taking a Human-Centered approach. Grapevine Health are also clearly aiming to remove the medical jargon and geographical boundaries in order to better suit care to the consumer

As digitisation of everything continues apace, every business that wants to compete in the target markets that make up Health and Home must offer a coherent design solution across every part of its product or service proposition – physical and digital – if it is to develop a loyal customer base. Clear and effective communication with consumers is critical as they look to choose brands that align with their values and convey a distinct digital presence.

The Challenge for Business

Consumer product businesses that have developed strong lifestyle brands within and across segments of the home market are rarely equipped to deliver health and wellness propositions that have the sophistication and credibility expected by today’s consumer. And healthcare market shifts towards patient centricity are forcing that industry to reconsider who they exist to serve. The answer often positions them squarely in markets previously dominated by home goods brands. All the noise from these disruptions is amplified in the online marketplace. The key problems faced by consumer lifestyle and home focused brands now, and increasingly over the next 5 years, are;

1. Credibility issues for consumer businesses wanting to win in Wellness

For consumer companies, meeting the demand for connected health/wellness propositions in a credible way requires a new approach - particularly where statements are made regarding efficacy and data needs to be shared with service providers (such as insurance companies) to incentivise adoption and repeat use. Recent efforts to build smart technology into all manner of consumer durables, appliances, fixtures and furniture have failed. We now see a consumer who has tired of gimmicks and demands systems that deliver results.

The topic of accessibility is often raised as an opportunity for companies to stand out against their competitors. Andrea Turner Moffit, Co-Founder and President of Plum Alley remarked last time out that ‘this pandemic has made all of us realize that technology can really help us solve some of our greatest challenges’ before going on to discuss resilience and how companies could move beyond gimmicks to deliver technology that helps people meaningfully.

2. New, well-funded competitors with knowledge of regulatory and reimbursement models

Healthcare brands are not yet experts on what motivates a consumer to choose one product over another. However, their time horizons and deep pockets mean they will be formidable players outside of their core markets. And their understanding of regulatory requirements and insurance reimbursement are key advantages. Coupled with the presence of tech firms experimenting across a wide variety of sectors, disruption will occur. Procter & Gamble discussed how this could be a positive thing for both business and the consumer , coining the term, “constructive disruption”.

3. Market dynamics are making innovation much riskier

Innovation has changed in recent years from a focus on products to a more complete customer experience. This requires a larger investment and alignment across multiple business teams who must work in parallel. Managing the risks associated with being first to market requires an evidence-based approach that removes internal friction and optimises the chances of commercial success post launch. If you want to see how one business has weathered the storm as a whole host of new trends and companies have emerged, take a look at how WW, formerly Weight Watchers, has shifted from weight loss to a ‘a tech-enabled, personalized wellness experience’ using the same technology driving many CES innovations - artificial intelligence and machine learning.

4. Brands need careful management and continuous investment to retain their audience

As the digital revolution continues, building and managing a clear, consistent and compelling brand vision that can compete in noisy markets is essential. Good companies know that failure to invest in their brand and marketing communications heightens the risk of quickly losing ground or becoming irrelevant.

Navigating Change

Companies who have made an honest assessment about these challenges and address them in their strategic planning are better prepared for the internal transformation needed to capitalise on these exciting new opportunities. They are also well positioned to take advantage of external expertise that provides agility in helping them manage tactical priorities, while remaining focused on their long-term strategic direction.

1. Credibility based on claims that matter in the Wellness market

Consumers are looking for propositions that are genuinely better and which can be backed up with evidence that supports claims of improved or differentiated performance. Using analytical processes that identify how a consumer understands a product or a service and therefore the criteria that matter to them is the first step to developing communications and positioning that will drive the consumer awareness and engagement in market. To succeed in the Wellness space, companies quickly need to integrate the expertise that can help them build trust with their consumers based around relevant and technically robust healthcare claims.

2. Platforms and partnerships that unlock new revenue potential

The race to build smart technology into all manner of consumer durables, appliances, fixtures and furniture has left consumers tired of gimmicks and demanding systems that are intelligent and useful. The fragmentation of the current market is being addressed by platforms that allow companies to collaborate rather than compete to succeed. Leveraging strategic partnerships saves businesses time and effort in the development of new core competencies - particularly in respect of data driven services.

We have seen this done in the name of sustainability, with Patagonia and Samsung sharing knowledge in order to keep microplastics out of our oceans. United & eMed also combined forces to create the BinaxNOW COVID test, making testing & traveling easier.

3. Proprietary consumer insight that can be turned into a competitive advantage

Using a combination of qualitative and quantitative research tools helps to build a data set that can inform strategic direction and provide a consistent focus for business on why certain things must be done. These techniques combine deep consumer insight with technological, cultural and commercial drivers, to reveal where valuable new products and services should be developed to deliver the most powerful ROI.

4. Brands that build loyalty online and offline

Instead of projecting what it thinks the customer wants to hear, smarter businesses are listening hard and making sure that brands are built on what customers really think and how they really make sense of what is presented to them. Recipe’s semiotics toolkit is one example of how an advanced analytical technique can ensure that communications are optimised to enable growth in new channels or help increase market share.

Tine Eide, Executive Vice President of Fraud and Banking Product Risk at American Express recently described how ‘we’ve seen more demand for easy and quick digital experiences, from application to account payment’. She says that they need to ‘show customers we’ve got their backs’, by anticipating customers’ needs with personalised offerings.

Jason Osbourne, Global Head of Consumer and Commercial Banking at global professional services firm Genpact, describes how ‘banks should be comparing themselves to technology companies…disruptors like Netflix, Amazon, and Uber.’

We are increasingly seeing these challenges prioritised by our clients and partners, with budgets being redirected toward R&D activity that defines meaning-centered opportunity for the company. Recent disruption has forced strategic re-evaluation – to really confront the changes taking place at a faster rate than many consumer facing businesses have ever seen before.

The art of navigating change is in maintaining a clear sense of longer-term strategic direction while simultaneously dealing with the next most important thing. This requires vision.

Recipe’s visioning programme looks at change from the perspective of both healthcare orientated and home lifestyle orientated perspectives. ADDFLO explores the possibilities that exist in healthcare as we think beyond the treatment of a condition – asthma – and towards informed control of respiratory health through a holistic wellness routine. The Unity Project explores the changing nature of our home environment and how it can become meaningfully smarter to empower us and positively impact on our wellbeing. Both demonstrate ways of embracing the possibilities of convergence – with wellness for the individual the common theme.

As convergence continues apace, consumer values shift and new technologies drive more complex and powerful integration, the challenge for leaders will centre on understanding what this can mean for the customers they serve - and how new forms of meaning can shape a compelling vision for their business.

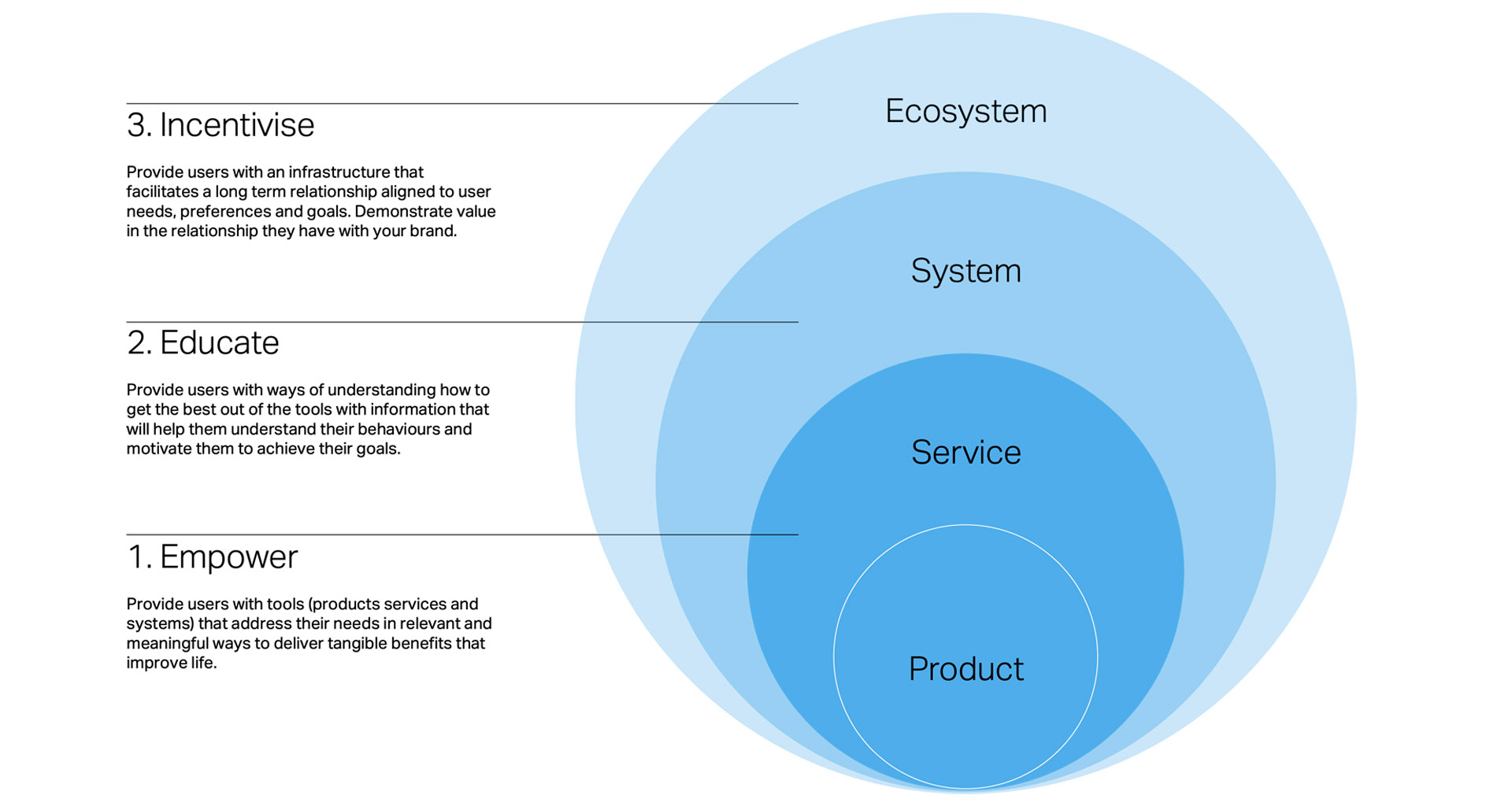

3 key principles that will shape brand success

1. Empower

Empower consumers with tools and insights which allow them heightened control over their health and wellbeing - but distinguish between data that is meaningful to them, and that which can be handled under the hood.

2. Educate

Move past the early archetypes of simply providing consumers with passive, non-functional insights, and provide them with the information and data which will help them to understand their actions, monitor progress and stay on course to achieve their goals.

3. Incentivise

Provide infrastructure within the devices and systems that facilitate a long-term relationship with the user. Build dialogue around progress and goals, and emphasise how the engagement is paying off for them as an ongoing positive choice.

Applying these principles to the ecosystem opportunity

Consumer expectation now extends well beyond ‘hard product’ and into services enabled by connectedness and intelligent interpretation of multiple data sets.

The challenge for businesses that have established a strong market position based on ‘hard’ product development has been in developing competencies in service design to deliver the extended functionality that is valued by the consumer of today.

The last decade has seen many companies embark on this journey - forcing a reevaluation of the proposition and a consideration of the total customer experience where the product has become a hub for services that help the brand extend its presence and find a position founded on lifestyle fit.

This has taken many into the realms of ‘system-thinking’ and with it the need to benchmark their service offering with that of other companies, not previously considered competitors, but now jostling for the attention of the consumer and a place in their homes and lives.To achieve this - and stay relevant - the relationship can no longer be based on a single or periodic transaction.

Technology has driven behaviour shifts and a rise in consumer expectations that puts the end user at the very centre of product and service-based systems that need to build and constantly nurture trust as data is exchanged for higher levels of convenience and control.

Technology is giving us the ability to capture, analyse and act upon data in ever more sophisticated ways. Doing this meaningfully requires deep user insight and feedback loops that nurture trust and understanding and enable satisfaction and value for the consumer. Making this meaningful demands that a brand is truly present across every touchpoint - online and offline. It means frequent interaction, contextual functionality and deep knowledge of the consumer.

This is the evolving ecosystem that will make every brand think again about how it best serves its customers.

About the Authors

Recipe COO Simon Browning has worked at the leading edge of the design industry for 25 years. Simon is an award-winning designer and business leader and has delivered programmes of work for global brands as diverse as Kohler, Unilever, LG and SC Johnson.

Michael Wandschneider has led product strategy for some of the world’s most iconic brands over the course of his 25-year career. His approach blends inside-out analytics with outside-in consumer insights to create lasting value for all stakeholders. Michael has curated a portfolio of products that have redefined technological, functional, and design benchmarks.

About Recipe Design

Recipe is a strategic design consultancy, dedicated to helping clients achieve growth through product and service innovation across the healthcare and home sectors.

The team at Recipe has spent over a decade pioneering the use of Meaning Centred Design™ - a unique process that helps businesses understand their customers and end users and how they perceive a branded proposition. Insights can be translated into new strategies and design solutions that are more relevant and meaningful, creating sustainable business value and minimising risk.

The team at Recipe has delivered award winning work for market leading brands including Sanofi, Kohler, Braun, Galderma and Bang & Olufsen.

For more information, please contact:

Natasha French

Client Services

+44 (0) 20 3176 5399

This article was first published in February 2022